maine transfer tax calculator

The State of Delaware transfer tax rate is 250. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes.

A Breakdown Of Transfer Tax In Real Estate Upnest

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied. Your average tax rate is 1198 and your marginal tax. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the York County Tax. Transfer Tax Calculator 2022 For All 50 States Our Land Transfer Tax Calculator Is Based By Province To Find Out How Much Land Transfer Tax To Calculate In To. The rates that appear on tax bills in Maine are generally denominated in millage rates.

The state has a high standard deduction that helps low- and middle-income Mainers at tax time. This lesson will examine Maines real estate transfer tax. Delaware DE Transfer Tax.

For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. The state income tax rate in Maine is progressive and ranges from 58 to 715 while federal income tax rates range from 10 to 37 depending on your income. The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred.

Some areas do not have a county or local transfer tax rate. A mill is the tax per thousand dollars in assessed value. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Our Maine State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 6250000 and go towards tax. The current rate for the Maine transfer tax is 220 per every 500 of the sale. The tax is imposed ½ on the grantor ½ on the grantee.

The state of Maine has a real estate transfer tax that is due whenever the deed to real estate is exchanged between two parties for money. If you make 70000 a year living in the region of Maine USA you will be taxed 12188. This calculator will estimate the title insurance cost and transfer tax for 1-4 unit residential properties.

Overview of Maine Taxes. In Maine when real property or even a partial interest in property is transferred there is usually transfer tax due which is paid to the Registry of Deeds at. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes.

This rate is split evenly between the seller and the purchaser. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. The transfer tax is customarily split evenly between the seller and the purchaser.

For the 2016 tax year the. The car sales tax in Maine is 550 of the purchase price of the vehicle. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

For comparison the median home value in York County is 23330000. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

The current rate for transfer tax is 220 per every five hundred dollars of consideration. This means that the applicable sales tax rate is the same no matter where you are in Maine. What is the income tax rate in Maine.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Find your Maine combined state and local tax rate. The current rate for the Maine transfer tax is 220 per every 500 of the sale.

No Maine cities charge a local income tax. Thats why we came up. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This calculator will estimate the title insurance cost and transfer tax for 1-4 unit residential properties. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Maine Property Tax Rates.

As such each party is required to pay 110 per every 500 or 220 for every 1000 of the price of the home. The states top rate still ranks as one of the highest in the US. Maine transfer tax calculator Wednesday June 22 2022 Edit.

For example if you purchase a new vehicle in Maine for 40000 then you will. But not more buyers sellers total if at least than half half transfer tax 0 500 110 110 220 state of maine real estate transfer tax - tax rates. As such each party is required to pay 110 per every 500 or 220 for every 1000 of the price of the home.

This state sales tax also applies if you purchase the vehicle out of state. For a 150000 home the buyer and seller in Maine will both pay 330 for the state. But not more buyers sellers total if at least than half half transfer tax 0 500 110 110 220 state of maine real estate transfer tax - tax rates.

Maine has a progressive income tax system that features rates that range from 580 to 715. Controlling Interest - A separate ReturnDeclaration must be filed for each. The base state sales tax rate in Maine is 55.

The transfer tax is collected on the following two transactions. Maine Income Tax Calculator 2021. Maine has a withholding tax that is payable upon the sale of.

Maine Income Tax Calculator 2021. This income tax calculator can help estimate your. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

How To Calculate Transfer Tax In Nh

Transfer Tax Calculator 2022 For All 50 States

Maine Real Estate Transfer Taxes An In Depth Guide

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

A Breakdown Of Transfer Tax In Real Estate Upnest

Should You Move To A State With No Income Tax Forbes Advisor

Tax Help Tips Tools Tax Questions Answered H R Block

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips

Dmv Fees By State Usa Manual Car Registration Calculator

Transfer Pricing Methods And Best Practices Insightsoftware

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

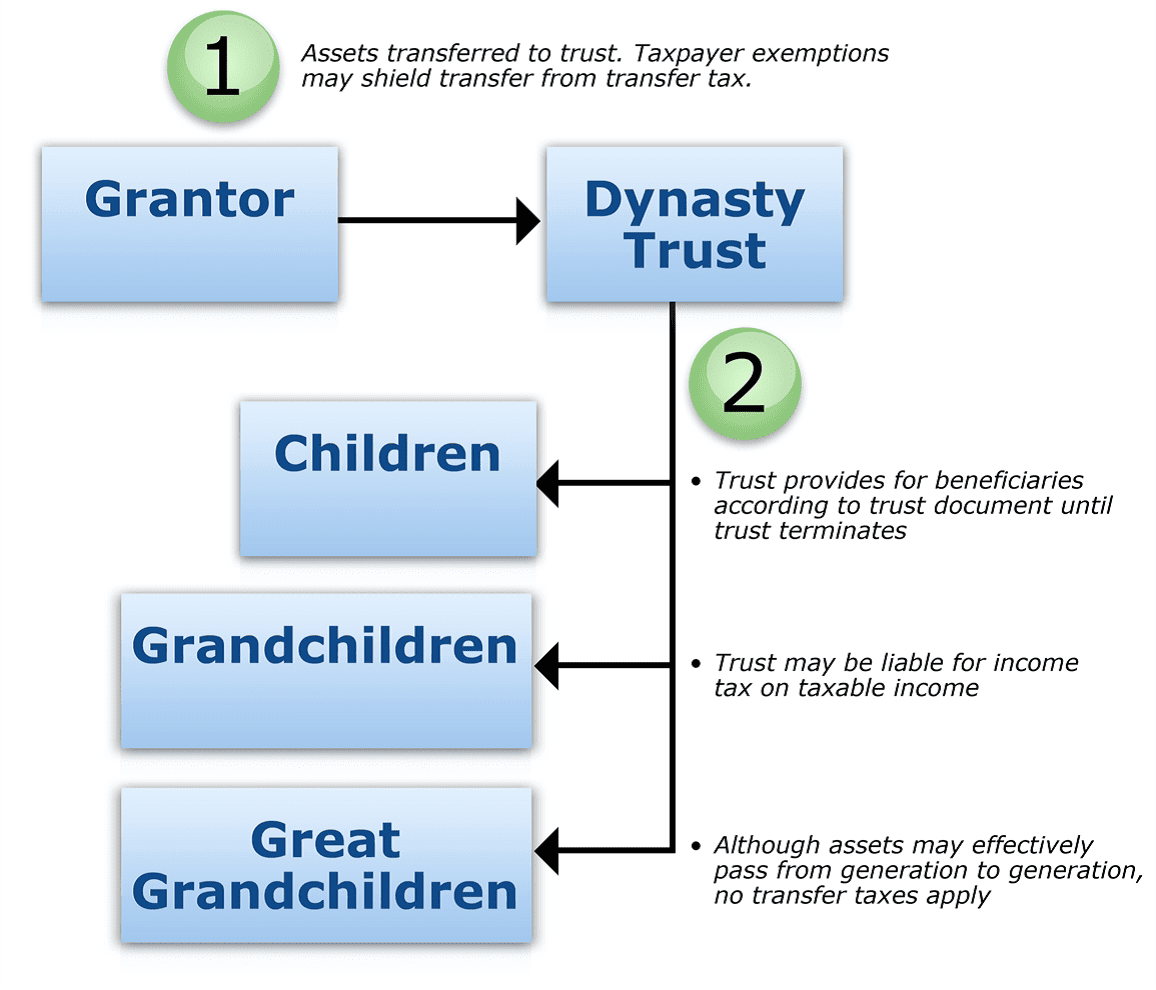

Is Your Legacy In A Dynast Trust Cwm

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips